For a growing number of people, “medical tourism” can be dangerous — even fatal.

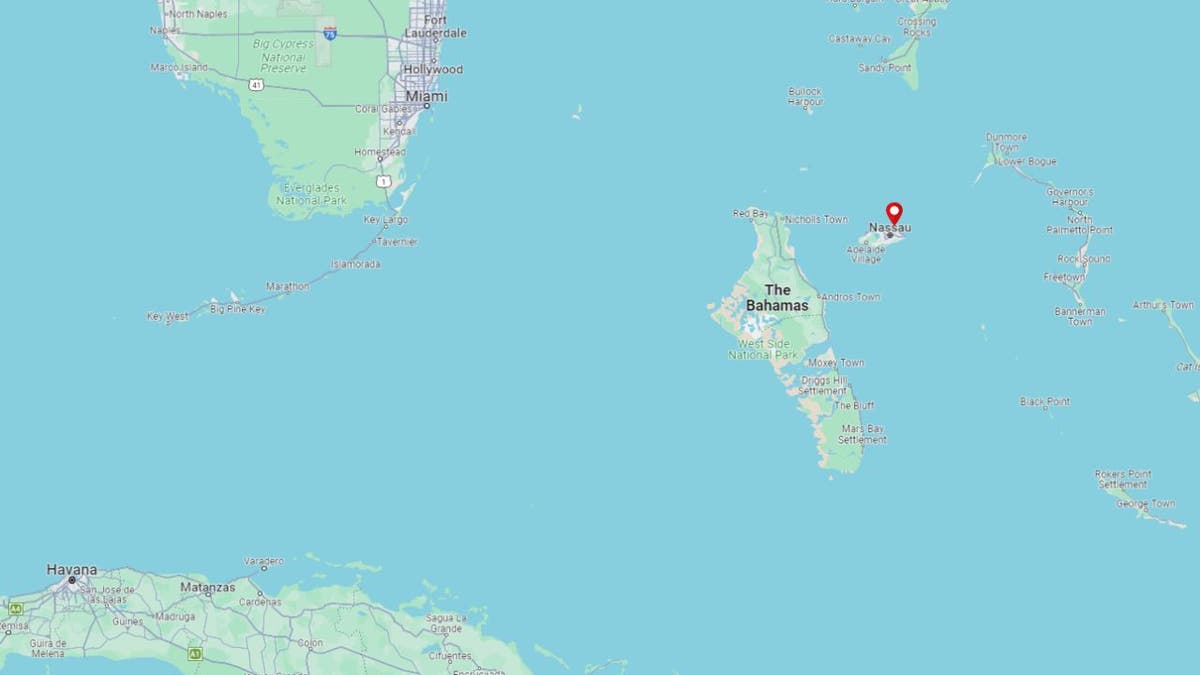

Twenty-nine U.S. citizens have died after they had cosmetic surgery in the Dominican Republic between 2009 and 2018, according to a Jan. 25 report from the Centers for Disease Control and Prevention (CDC).

More alarming is that the deaths have spiked in recent years. Between 2009 and 2018, there were an average of 4.1 deaths per year. Between 2019 and 2022, that average rose to 13 per year — peaking at 17 deaths in 2020.

ASK A DOC: ‘WHAT SHOULD I DO, OR NOT DO, PRIOR TO SURGERY?’

The deaths were linked to “fat or venous thromboembolism,” which is when a blood clot forms in a vein, the CDC reported.

Most of the patients had risk factors for the condition, such as obesity, diabetes, tobacco use and multiple surgical procedures being performed at once.

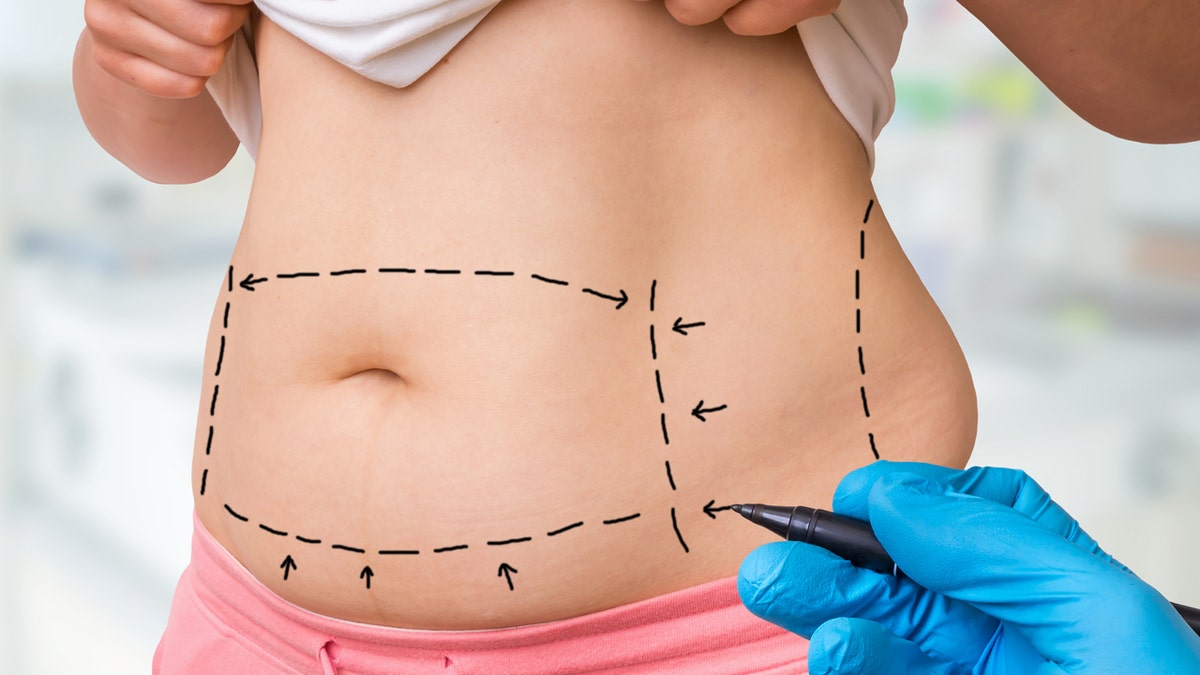

To ensure a safe procedure, the surgeon — as well as the entire surgical team, including the anesthesiologists, nurses and surgical techs — should be adequately trained in the specific procedures, a doctor noted. (iStock)

The Consular Section of the U.S. Embassy in the Dominican Republic has recorded cosmetic surgery-associated deaths among U.S. citizens since 2009.

The embassy contacted the CDC upon noticing the uptick in deaths — which sparked an investigation.

All but one of the deaths involved women, the report stated. The average age of the patients at the time of death was 40.

TOP PLASTIC SURGERIES: THESE WERE THE MOST IN-DEMAND PROCEDURES IN 2022

For the 24 deaths that occurred between 2019 and 2020, liposuction was performed on all of the patients, usually along with other procedures, including gluteal fat transfer, abdominoplasty and breast augmentation.

Fat embolism was the cause of death in 55% of the cases and pulmonary venous thromboembolism was the determining cause in 35% of the cases, the report said.

Plastic surgeons’ reactions

Josef Hadeed, M.D., chair of the Patient Safety Committee for the American Society of Plastic Surgeons (ASPS), who was not involved in the CDC investigation, noted that the CDC’s report highlights the dangers associated with destination procedures.

For the 24 deaths that occurred between 2019 and 2020, liposuction was performed in all of the patients, usually along with other procedures. (Fox News Digital)

“Too often, patients will travel to other countries as the procedures are cheaper there,” Hadeed, who is also a plastic surgeon with practices in Beverly Hills, California, and Miami, Florida, told Fox News Digital in an interview.

“However, there are a lot of risks associated with traveling to other countries for cosmetic procedures.”

He added, “All surgery carries risk, but there are excessive deaths outlined in the report, most of which were presumably avoidable.”

“Just because something is cheaper doesn’t mean it is better for you.”

When it comes to the price of surgery, Hadeed advised patients that “you get what you pay for. Just because something is cheaper doesn’t mean it is better for you.”

He also said, “The most important issue in plastic surgery is patient safety.”

It is critical to find a plastic surgeon who is board-certified by the American Board of Plastic Surgery and is a member of the American Society of Plastic Surgeons, experts agreed. (iStock)

Jonathan Kaplan, M.D., a board-certified plastic surgeon who practices at Pacific Heights Plastic Surgery in San Francisco, who was also not involved in the report, said the CDC’s latest findings are “sad but true.”

“There are risks with any surgery, but in the U.S., you have a better sense of whether doctors are board-certified in the specialty they’re practicing in,” he told Fox News Digital in an email.

“There is also the added risk of going to a facility in a foreign country that has no quality assurance or safety protocols as required by law in the U.S.,” Kaplan added.

Heightened risks

International travel automatically puts patients at a higher risk for thromboembolic events, where they can develop potentially fatal blood clots, Hadeed said.

Another consideration is that those having surgery outside the U.S. won’t be able to get any assistance from the doctor if any complications arise, Kaplan warned.

BBL NOT ALWAYS A-OK: WHY THE BRAZILIAN BUTT LIFT IS ONE OF THE DEADLIEST PLASTIC SURGERIES EVER

“Then you’ll have to find a doctor locally who will charge you an exorbitant amount to fix the problem and you’ll end up spending more than what you saved initially,” he said.

While all surgeries carry some element of risk, the “Brazilian Butt Lift” (BBL) has been associated with the highest risk of death in plastic surgery, which is corroborated by the report, noted Hadeed.

Twenty-nine U.S. citizens have died after having cosmetic surgery in the Dominican Republic between 2009 and 2018, according to a Jan. 25 report from the Centers for Disease Control and Prevention (CDC). (REUTERS/Tami Chappell/File Photo)

“While I cannot specifically comment on what led to the deaths in the Dominican Republic, I can say that using an ultrasound is essential while performing a Brazilian Butt Lift,” he told Fox News Digital.

When the fat is injected into one of the blood vessels within the gluteal muscle, it can enter the bloodstream and make its way to the blood vessels of the lungs, blocking off circulation and leading to immediate death — which constitutes a fat embolism, the doctor said.

ASK A DOC: ‘WHAT SHOULD I KNOW BEFORE GETTING A BREAST LIFT?’

This can be prevented by using an ultrasound, he noted, which allows the plastic surgeon to visualize the gluteal muscle and ensure that the fat is placed above, and not within, the muscle.

“This has already become state law in Florida as of 2023,” said Hadeed.

Safety tips

While Hadeed said it’s “better” to look for plastic surgeons within the U.S., if patients do decide to travel outside the country, they should carefully research a provider.

It is critical to find a plastic surgeon who is board-certified by the American Board of Plastic Surgery and is a member of the American Society of Plastic Surgeons, Hadeed emphasized.

The surgeon — as well as the entire surgical team, including the anesthesiologists, nurses and surgical techs — should be adequately trained in the specific procedures, the doctor added.

The “Brazilian Butt Lift” (BBL) has been associated with the highest risk of death in plastic surgery, the report stated. (iStock)

“It is equally important to ensure that the facility in which the procedure is being performed is fully accredited to the same standards that are found in the United States and has the proper safety measures in place,” said Hadeed.

“The money you save is not worth it if you have a complication, which is a very real possibility.”

“Also remember that longer flights increase the risk of venous thromboembolism, and it is advised to wait several days after travel before undergoing a surgical procedure, which can add to the cost of the travel when you factor in additional days of staying in a hotel,” he pointed out.

When asked for his advice on international surgery, Kaplan said simply, “Don’t do it.”

Those having surgery outside the U.S. won’t be able to get any assistance from the doctor if any complications arise, an expert warned. (iStock)

“The money you save is not worth it if you have a complication, which is a very real possibility,” he said.

“And remember, complications don’t have to be major — they can be minor, but still a nuisance if you don’t have a doctor locally to take care of it,” he went on. “And even the smallest complication will be much more expensive to take care of in the U.S. if your original surgery was outside the country.”

CLICK HERE TO SIGN UP FOR OUR HEALTH NEWSLETTER

For those who are considering having an elective surgical procedure outside the U.S., the CDC recommends discussing the risks with a doctor here first.

The agency also emphasized the importance of surgeons conducting proper preoperative exams and only performing one procedure for each operation.

Potential limitations

The study did have some limitations, the CDC acknowledged.

All but one of the deaths involved women, the report stated. The average age of the patients at the time of death was 40. (iStock)

“No reliable statistics on the number of U.S. citizens who receive cosmetic surgery in the Dominican Republic each year are available, precluding calculation of the risk for perioperative death,” the report stated.

Also, the data only included deaths that were reported to the U.S. Embassy — which means the actual number could be higher.

CLICK HERE TO GET THE FOX NEWS APP

The mortality count also does not include deaths resulting from post-surgical infections, the CDC noted.

Fox News Digital reached out to the CDC requesting comment on the report.

For more Health articles, visit www.foxnews.com/health.

Melissa Rudy is the health editor and a member of the lifestyle team at Fox News Digital. Story tips can be sent to melissa.rudy@fox.com