Andy Cohen, the host of Bravo’s “Watch What Happens Live with Andy Cohen,” recently revealed he was scammed out of a large sum of money by an imposter who pretended to be from his bank.

He shared his story on TV, social media and on his Sirius XM “Andy Cohen’s Daddy Diaries Podcast,” hoping to raise awareness and prevent others from falling into the same trap.

“Andy Cohen’s Daddy Diaries Podcast” (Sirius XM)

What is an imposter scam?

An imposter scam is when someone contacts you pretending to be someone you trust, such as a government official, a bank employee, a family member or a friend.

CLICK TO GET KURT’S FREE CYBERGUY NEWSLETTER WITH SECURITY ALERTS, QUICK VIDEO TIPS, TECH REVIEWS, AND EASY HOW-TO’S TO MAKE YOU SMARTER

They may use fake names, phone numbers, email addresses, or websites to trick you into giving them your money or personal information. They may also use threats, promises or emotional appeals to pressure you into acting quickly.

According to the Federal Trade Commission (FTC), imposter scams are the most common type of fraud reported by consumers in the U.S.

How did Andy Cohen get scammed?

Cohen said that his ordeal started when he lost his bank card and reported it lost. The next day, he received an email that looked like it was from his bank’s fraud alert system. The email asked him to click on a link and sign in to his bank account to verify some suspicious transactions. This is how it all went down from there.

CLICK HERE FOR MORE US NEWS

Andy Cohen (Getty Images for Sirius XM)

The fake email that started it all

Cohen said he clicked on the link and entered his username and password, thinking that the email was legitimate. However, he later realized that the link was fake and that he had given the scammers access to his bank account.

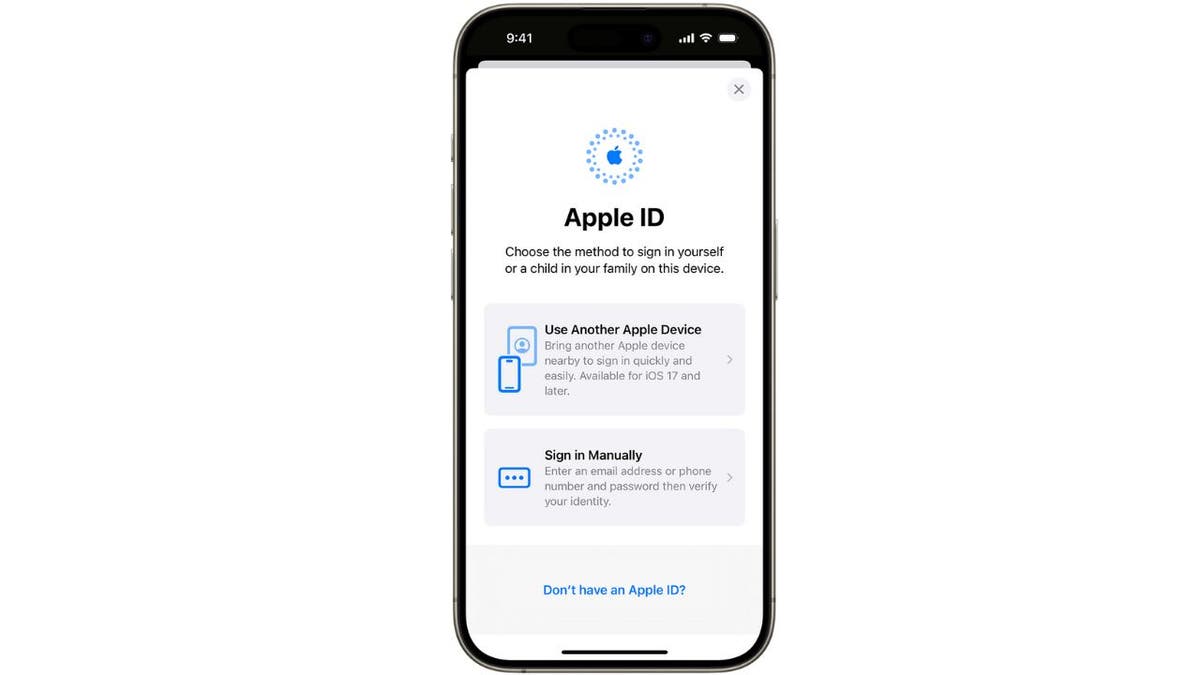

The Apple ID request that gave them access

The scammers then asked him to sign in to his Apple ID, which he said was a red flag. He said he closed the browser and ignored the request, but it was too late. The scammers had already gained control of his phone and his bank account.

Apple ID on iPhone (Apple)

The text and phone call that confirmed the scam

The next day, he received a text message from what appeared to be his bank, asking him if he was trying to use his card. He replied that it was not him, and then he received a phone call from someone who claimed to be from his bank’s fraud department.

The caller asked him to confirm some recent charges on his account, which he said were accurate because the scammers could see his transactions. The caller then said they would send him some codes to verify his identity and asked him to read them back.

The codes that were actually wire transfers

Cohen said he received three codes, which he later learned were actually wire transfers from two of his accounts to the scammers. He said he thought he was talking to his bank and that the codes were part of the security process.

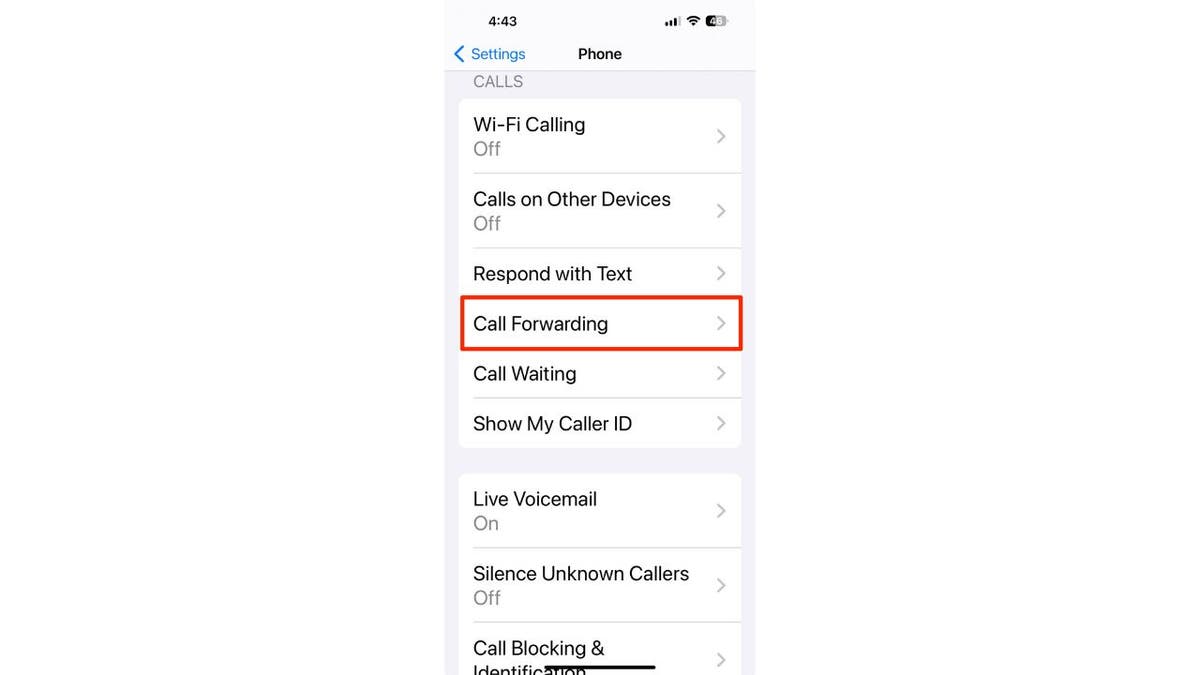

The call-forwarding trick that blocked the real bank

The scammers then did something even more sneaky. They asked him to enter some numbers, which they gave him, on his phone’s keypad, which activated the call-forwarding feature. This meant that any incoming calls to his phone would be redirected to the scammers, including the calls from his real bank.

Call forwarding on iPhone (Kurt “CyberGuy” Knutsson)

Cohen said he tried calling his bank’s fraud number but never received a callback. He said his phone was silent all night, which he found strange. The next day, a visit to his bank revealed that a significant sum of money had been wired out of his account, the exact amount of which he did not reveal. Cohen highlighted the harsh reality that once money is wired out, it’s generally not recoverable.

The discovery of the loss and the report to the police

He said he reported the incident to the NYPD Cyber Security Unit and that the case was still under investigation. He said he wanted to share his experience to warn others.

MORE: PROTECT YOURSELF FROM TECH SUPPORT SCAMS

How can you avoid imposter scams?

Andy Cohen shared some tips on how to avoid imposter scams based on what he learned from his experience. Here is his advice, along with some additional suggestions.

1) Check the email address

If you receive an email that claims to be from your bank, your government, or any other organization, always check the sender’s email address. It may look official, but if you click on it, you may see that it is not from the domain you expect. For example, it may say “Bank of America,” but the email address may be something like “bankofamerica@gmail.com” or “bankofamerica@fraud.com.” Do not click on any links or attachments in the email, and do not reply to it. Instead, contact the organization directly using a phone number or a website that you know is genuine.

2) Avoid the sense of urgency

Many imposter scams rely on creating a sense of urgency or panic in the victim. They may tell you that your account has been hacked, that you owe money to the IRS, that your loved one is in trouble, or that you have won a prize. They may ask you to act quickly and send money, provide personal information, or buy gift cards. Do not let them rush you or pressure you. Take a breath and think twice before you respond. If you are not sure, talk to someone you trust, such as a friend, a family member, or a financial advisor. Remember, legitimate organizations will never ask you to pay them with gift cards, wire transfers, or cryptocurrency.

3) Verify the caller’s identity

If you receive a phone call from someone who claims to be from your bank, your government, or any other organization, do not trust them blindly. They may use fake names, phone numbers, or caller ID information to fool you. They may also have some information about you, such as your name, your address, or your account number, to make you think they are real. However, this does not mean they are who they say they are. They may have obtained this information from public sources, data breaches, or previous scams. Do not give them any more information, such as your password, your PIN, your social security number, or your credit card number. Do not agree to any requests, such as sending money, buying gift cards, or entering codes. Instead, hang up and call the organization directly using a phone number that you know is genuine. You can also check the organization’s website for any alerts or warnings about scams.

4) Protect your devices: Have good antivirus software on all your devices

Imposter scammers may try to access your devices, such as your computer, your phone, or your tablet, to steal your information or money. They may send you fake emails, texts, or pop-ups that ask you to click on a link, download a file, or install software. Do not do it.

CLICK HERE TO SIGN UP FOR THE ENTERTAINMENT NEWSLETTER

They may also ask you to sign in to your online accounts, such as your email, your bank, or your Apple ID. Do not fall for these tricks. They may infect your devices with malware, spyware, or ransomware, or they may lock you out of your accounts.

The best way to protect yourself from these types of cyberthreats or having your data breached is to have antivirus protection installed on all your devices. Having good antivirus software actively running on your devices will alert you of any malware in your system, warn you against clicking on any malicious links in phishing emails, and ultimately protect you from being hacked. Get my picks for the best 2024 antivirus protection winners for your Windows, Mac, Android & iOS devices.

5) Use strong and unique passwords

Create strong passwords for your accounts and devices, and avoid using the same password for multiple online accounts. Consider using a password manager to securely store and generate complex passwords. It will help you to create unique and difficult-to-crack passwords that a hacker could never guess. Second, it also keeps track of all your passwords in one place and fills passwords in for you when you’re logging into an account so that you never have to remember them yourself. The fewer passwords you remember, the less likely you will be to reuse them for your accounts.

6) Perform regular software updates

Developers frequently release updates to patch vulnerabilities and improve overall security. Both Apple and Android issue updates regularly, so check for and install them often.

Scam alert illustration (Kurt “CyberGuy” Knutsson)

MORE: THE ‘UNSUBSCRIBE’ EMAIL SCAM IS TARGETING AMERICANS

I’ve been scammed like Andy. What to do next?

Below are some next steps if you find you or your loved one is a victim of identity theft from an imposter scam.

1) Change your passwords. If you suspect that your phone has been hacked or that someone is impersonating you, they could access your online accounts and steal your data or money. ON ANOTHER DEVICE (i.e., your laptop or desktop), you should change your passwords for all your important accounts, such as email, banking, social media, etc. You want to do this on another device so the hacker isn’t’ recording you setting up your new password on your hacked device. Use strong and unique passwords that are hard to guess or crack. You can also consider using a password manager to generate and store your passwords securely.

2) Look through bank statements and check account transactions to see where outlier activity started.

CLICK HERE TO GET THE FOX NEWS APP

3) Use a fraud protection service. Identity Theft companies can monitor personal information like your Social Security Number (SSN), phone number, and email address and alert you if it is being sold on the dark web or being used to open an account. They can also assist you in freezing your bank and credit card accounts to prevent further unauthorized use by criminals.

Some of the best parts of using an identity theft protection service include identity theft insurance to cover losses and legal fees and a white glove fraud resolution team where a US-based case manager helps you recover any losses. See my tips and best picks on how to protect yourself from identity theft.

4) Report any breaches to official government agencies like the Federal Communications Commission.

5) You may wish to get the professional advice of a lawyer before speaking to law enforcement, especially when you are dealing with criminal identity theft and if being a victim of criminal identity theft leaves you unable to secure employment or housing

6) Alert all three major credit bureaus and possibly place a fraud alert on your credit report.

7) Run your own background check or request a copy of one if that is how you discovered your information has been used by a criminal.

8) Alert your contacts. If hackers have accessed your device through SMS spoofing, they could use them to send spam or phishing messages to your contacts. They could impersonate you and ask for money or personal information. You should alert your contacts and warn them not to open or respond to any messages from you that seem suspicious or unusual.

9) Restore your device to factory settings. If you want to make sure that your device is completely free of any malware or spyware, you can restore it to factory settings. This will erase all your data and settings and reinstall the original version. You should back up your important data BEFORE doing this, and only restore it from a trusted source.

If you are a victim of identity theft, the most important thing to do is to take immediate action to mitigate the damage and prevent further harm.

MORE: ALL NEW TRICKY THREAT OF THE FAKE BROWSER UPDATE SCAM

Kurt’s key takeaways

Imposter scams are a serious threat that can cost you a lot of money and stress. Andy Cohen learned this the hard way, but he decided to share his story to help others avoid the same mistake.

By following his tips and the FTC’s advice, you can protect yourself and your loved ones from imposter scammers. Remember, if something sounds too good to be true, or too bad to be true, it probably is. Be smart, be vigilant, and be safe.

How do you think the authorities and the banks should handle imposter scams and help the victims recover their losses? Let us know by writing us at Cyberguy.com/Contact.

For more of my tech tips & security alerts, subscribe to my free CyberGuy Report Newsletter by heading to Cyberguy.com/Newsletter.

Ask Kurt a question or let us know what stories you’d like us to cover.

Answers to the most asked CyberGuy questions:

Copyright 2024 CyberGuy.com. All rights reserved.

Kurt “CyberGuy” Knutsson is an award-winning tech journalist who has a deep love of technology, gear and gadgets that make life better with his contributions for Fox News & FOX Business beginning mornings on “FOX & Friends.” Got a tech question? Get Kurt’s CyberGuy Newsletter, share your voice, a story idea or comment at CyberGuy.com.