It’s that time of year again, folks. Whether you have yet to file your taxes or you’re in the middle of it, it’s not too late to make sure you’re protected this tax season. With new tax fraud scams on the rise — many increasing due to the acceleration of AI — we want you to take extra security measures to keep yourself safe from these scams. But how? Here’s why you need an Identity Protection Pin this tax season.

Post-it note on tax documents (Kurt “CyberGuy” Knutsson)

Scammers who commit tax fraud are on the rise

Last year, over a million tax returns were flagged for possible identity theft, and the numbers aren’t looking to go down any time soon. With the advancements in AI, savvy scammers can more efficiently steal someone’s identity, create a fake ID and file a tax return in the victim’s name.

When they do that, they can get a tax refund sent directly to their bank account, all the while causing havoc for the victim, who will learn of the scam often when it’s too late when they go to file their taxes.

The word scam is written on tax documents. (Kurt “CyberGuy” Knutsson)

MORE: DON’T FALL FOR THESE SNEAKY TAX SCAMS THAT ARE OUT TO STEAL YOUR IDENTITY AND MONEY

What is an Identity Protection Pin and how does it keep you safe?

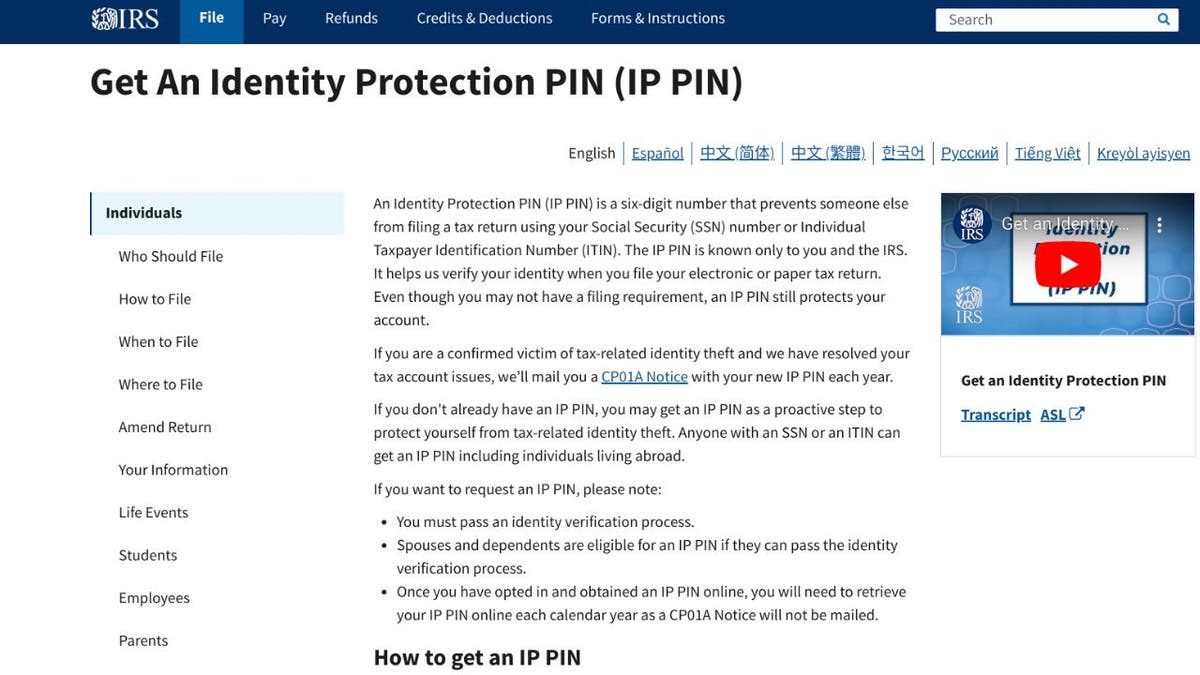

To combat tax identity theft, the IRS has created Identity Protection (IP) PINs. These are six-digit, personalized numbers that you are asked to enter when filing your tax return, either electronically or on paper. While it’s not a requirement for everyone to have an IP PIN, the IRS will assign one to those who have been previously victims of tax fraud and require them to use it.

But, for those who have not been victims of tax fraud before, as determined by the IRS, it’s still a good idea to get yourself an Identity Protection PIN anyway. This PIN — as long as you don’t share it with anyone — helps prevent scammers from filing tax returns in your name with your compromised identity. Without that pin, they won’t be able to go a step further.

So, why wait until you become a victim of tax fraud? If that happens, you’ll need an IP PIN anyway. Stop these scammers in their tracks because these scammers are more sophisticated. Sure, it may take a little longer to file your return, but it’s worth it.

IP PIN page on IRS website (Kurt “CyberGuy” Knutsson)

MORE: HOW CRYPTO IMPOSTORS ARE USING CALENDLY TO INFECT MACS WITH MALWARE

How to apply for an Identity Protection Pin

To apply for an IP PIN, go to the IRS’ online tool. Have your valid Social Security number or individual taxpayer identification number (ITIN ready). Remember, if the IRS has already determined that you’re a victim of tax fraud, they’ll already have assigned you an IP PIN.

If you apply online, you can get your IP PIN in about 15 minutes, provided you meet the eligibility requirements. Applying by mail using Form 15227 takes longer. The IRS will typically mail you your IP PIN within four to six weeks after verifying your identity. Luckily, the April 15 deadline applies to filing your tax return, not necessarily obtaining an IP PIN. So, as long as you receive your IP PIN before you file, you should be fine.

Once your application is approved, the IRS will assign you a six-digit IP PIN. Write this down somewhere safe. Once you receive your IP PIN, you won’t be able to file your tax return without it.

How do I use my IRS IP PIN?

If you file your tax return yourself because you’re eligible via Direct File at the IRS website, then you’ll be prompted to put in your IP PIN when you log in to your account. But, if you have an accountant, wait until you review the tax return they’ve put together before you share your pin with them to do it via the IRS website. Otherwise, if you’re filing the tax return via tax software, it should prompt you to put in your IP PIN before going forward. If you need help with your IP PIN, visit the IRS’s FAQs or contact the IRS directly.

Important Information about IP PINs

Here’s additional information you might want to know about IP PINs.

- An IP PIN is valid for one calendar year. If you already have a pin, when you log in the next year, you’ll be granted a new pin.

- A return filed without the code won’t be accepted. While this may be an annoyance for some taxpayers, it’s all to help curb a large number of scams happening, which is resulting in more than $6 billion in tax refunds sent out to the wrong people.

- Logging back into the “Get an IP PIN” tool will display your current IP PIN.

A person preparing their taxes (Kurt “CyberGuy” Knutsson)

MORE: CONFESSIONS FROM A VICTIM SCAMMED BY CYBERCREEPS

How can you protect yourself from tax-related identity theft?

Use an identity theft protection service

If you’re worried about scammers not just wanting to commit tax fraud, but stealing your information for any of their malicious reasons, like identity fraud, we understand. There are so many scams out there and so much information that you need to know to keep yourself protected. Luckily, there are solutions that can help, including an identity theft protection service.

Identity Theft companies can monitor personal information like your Social Security Number, phone number and email address and alert you if it is being sold on the dark web or being used to open an account. They can also assist you in freezing your bank and credit card accounts to prevent further unauthorized use by criminals. See my tips and best picks on how to protect yourself from identity theft.

Have good antivirus software

The best way to protect yourself from clicking malicious links that install malware that may get access to your private information is to have antivirus protection installed on all your devices. This can also alert you of any phishing emails or ransomware scams. Get my picks for the best 2024 antivirus protection winners for your Windows, Mac, Android & iOS devices.

5 things to do if you are a victim of identity theft

1) Complete IRS Form 14039, the Identity Theft Affidavit. This is the form that all victims of fraud have to fill out for the IRS. It will let them know that the person claiming to be you is a fraud. You can find the form on the IRS website.

2) Request a copy of the fraudulent tax return from the IRS. You can do this by going to this page on the IRS website to learn how to deal with fraudulent returns and follow the instructions to order a copy.

3) Alert national credit bureaus: Let the national bureaus like Experian, Equifax and TransUnion know that there has been fraud and place a freeze on your account so that the scammers cannot get to it.

4) Report the crime to the Federal Trade Commission: The FTC is there to help track down scammers, and your report can also help them keep a record of how many scams are happening in a single year so that they can better improve how to warn others. You should also report the crime to identitytheft.gov/.

5) Check your online bank accounts: Make sure there aren’t any suspicious transactions on any of them.

Kurt’s key takeaways

Tax fraud is not new, but it’s happening much more frequently these days. The IRS is doing its part to try and protect taxpayers, but it’s not easy to keep up. By applying for the Identity Protection PIN, you can help them help you.

In your opinion, how can the IRS better educate taxpayers about protecting themselves from tax scams? Let us know by writing us at Cyberguy.com/Contact.

For more of my tech tips & security alerts, subscribe to my free CyberGuy Report Newsletter by heading to Cyberguy.com/Newsletter.

Ask Kurt a question or let us know what stories you’d like us to cover.

Answers to the most asked CyberGuy questions:

Copyright 2024 CyberGuy.com. All rights reserved.